Blogs

Top 10 Web Hosting Trends for 2026

September 18, 2025

Top 10 Cloud Trends You Can’t Afford to Ignore in 2026

September 23, 2025AI Server Boom: Dell, HPE and Nvidia Riding The Wave

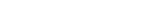

Dell:

In its Q2 FY 2026 earnings call, Dell’s Chief Operating Officer Jeff Clarke stated, “We have shipped more AI servers in the first half of this year than all of last.” Sequential delivery of AI infrastructure helped drive 19% year‑over‑year revenue growth to a record $29.8 billion in the three months ending August 1. Its server and networking segment soared 69%, reaching $12.9 billion.

HPE:

Q3 FY 2025 revenues climbed 18% year‑over‑year to $9.1 billion. CEO Antonio Neri attributed this to customers “refreshing aged infrastructure with more richly configured servers”. The company also posted $4.9 billion in server segment revenue, up 16% year‑over‑year and 21% sequentially. Notably, AI systems generated $1.6 billion in revenue for the quarter.

Market Context:

Artificial intelligence is powering a historic surge in server demand. In Q1 2025, global AI server sales jumped 134% year‑over‑year to $95.2 billion, marking the fastest quarterly growth in 25 years, according to IDC. Gartner forecasts end‑user server spending hitting $367 billion in 2025, roughly a 60% increase over 2024.

IDC research also reveals that AI server demand was virtually nonexistent in 2021. is expected to triple that of traditional servers by 2027, illustrating the dramatic shift toward artificial intelligence deployments. This is no longer limited to cloud giants and model builders; enterprises across industries are accelerating hardware refresh cycles to support artificial intelligence workloads, raising both internal performance expectations and data security considerations.

NVIDIA’s Enterprise Push: Open‑Source AI and GPU Servers

As CEO Jensen Huang celebrated the role of open‑source models in driving enterprise AI adoption, it is clear that Nvidia’s strategy is evolving. Huang noted, “Open‑source models are opening up large enterprises, SaaS companies, industrial companies, robotics companies to now join the AI revolution because enterprises want to build their own custom proprietary software stacks.”

To support that shift, Nvidia launched the GPU‑powered RTX Pro server, designed for conventional IT environments yet capable of advanced agentic and physical AI workloads. Customers include Disney, Hyundai, Lilly, SAP, and others. The product line is positioned to become a multibillion‑dollar revenue stream.

Revenue Trends

- NVIDIA reported $46.7 billion in revenue for the most recent quarter, with year‑over‑year growth holding robust at 56%, slightly down from 69% in the prior quarter but still significantly strong.

- Expansion of revenue has been driven by hyperscaler investment: Google Cloud, Microsoft, and Amazon Web Services are committing tens of billions in capital to AI infrastructure, further fueling GPU demand.

- The company anticipates continued mid‑50% year‑over‑year growth as enterprise and hyperscale demand expands.

- On the broader AI infrastructure outlook, Nvidia projects a $3-4 trillion total addressable market over the next 10 years.

Energy efficiencies and smaller-memory models are starting to temper GPU demand growth, though enterprises still require AI compute to scale their operations.

What does this mean for the AI Server Ecosystem?

1. AI servers are now enterprise infrastructure

AI servers are becoming ubiquitous across sectors, not only in hyperscale data centers but increasingly in private enterprise data centers. This is prompting large-scale hardware refreshes.

2. Dell and HPE are capitalizing on enterprise demand

Both companies posted double-digit growth fueled by AI infrastructure as enterprises modernize data centers.

- Dell generated a record $29.8 billion in revenue, up 19% year‑on‑year, with server-networking hitting $12.9 billion (+69%).

- HPE reported $9.1 billion in total revenue (+18%) with $1.6 billion from AI systems.

3. Nvidia anchors the AI hardware stack

Through both GPU silicon and turnkey server platforms like RTX Pro, Nvidia is firmly positioned as the go-to vendor for AI compute, enjoying explosive growth, $46.7 billion quarterly revenue, and growing at 56% year‑over‑year.

4. The market outlook remains expansive

Global AI server sales are up massively (134% YoY in Q1), and forecasted spending (e.g., Gartner’s $367 billion in 2025) shows sustained momentum. NVIDIA projects a multitrillion-dollar AI infrastructure market ahead.

Conclusion

Enterprises are embracing AI hardware at an unprecedented scale. The combination of skyrocketing AI server demand, enterprise buying cycles, and corporate confidence in AI capabilities is reshaping the infrastructure landscape:

- Dell and HPE are capitalizing on AI-driven momentum with strong revenue gains.

- NVIDIA is both the engine and product provider behind this transformation, offering GPU platforms and tailored server solutions.

- Analysts and market forecasters expect this wave to continue with AI infrastructure shaping the AI server market growth for years to come.

As artificial intelligence transitions from innovation to mission-critical enterprise infrastructure, the strategic stakes for hardware providers like Dell, HPE, and Nvidia have never been higher.

Featured Post

Snowflake and OpenAI Seal $200M Strategic Alliance to Transform AI For Enterprise Data Platforms

Snowflake, the AI Data Cloud leader, and OpenAI this week announced a multi-year, $200 million strategic partnership that will bring advanced artificial intelligence models directly into […]

Cisco Live EMEA 2026: Powering the AI Era with Smarter Networks, Security, Collaboration and Agentic Intelligence

At Cisco Live EMEA 2026 in Amsterdam, Cisco unveiled a sweeping portfolio of innovations designed to transform enterprise infrastructure, secure AI-driven environments, and redefine workplace collaboration […]

Microsoft Unveils Maia 200 AI Chip to Take On AWS, Google and Nvidia in Cloud AI Race

Microsoft Unveils Maia 200 AI Chip to Take On AWS, Google and Nvidia in Cloud AI Race. Microsoft has officially launched its next-generation AI accelerator chip, […]