Blogs

Dedicated Server for Education: Everything You Need to Know

August 15, 2025

Intel Holds Ground Against AMD Amid Market Noise and Leadership Drama

August 21, 2025SoftBank Invests $2 Billion in Intel as U.S. Government Eyes 10 % Stake in Chipmaker

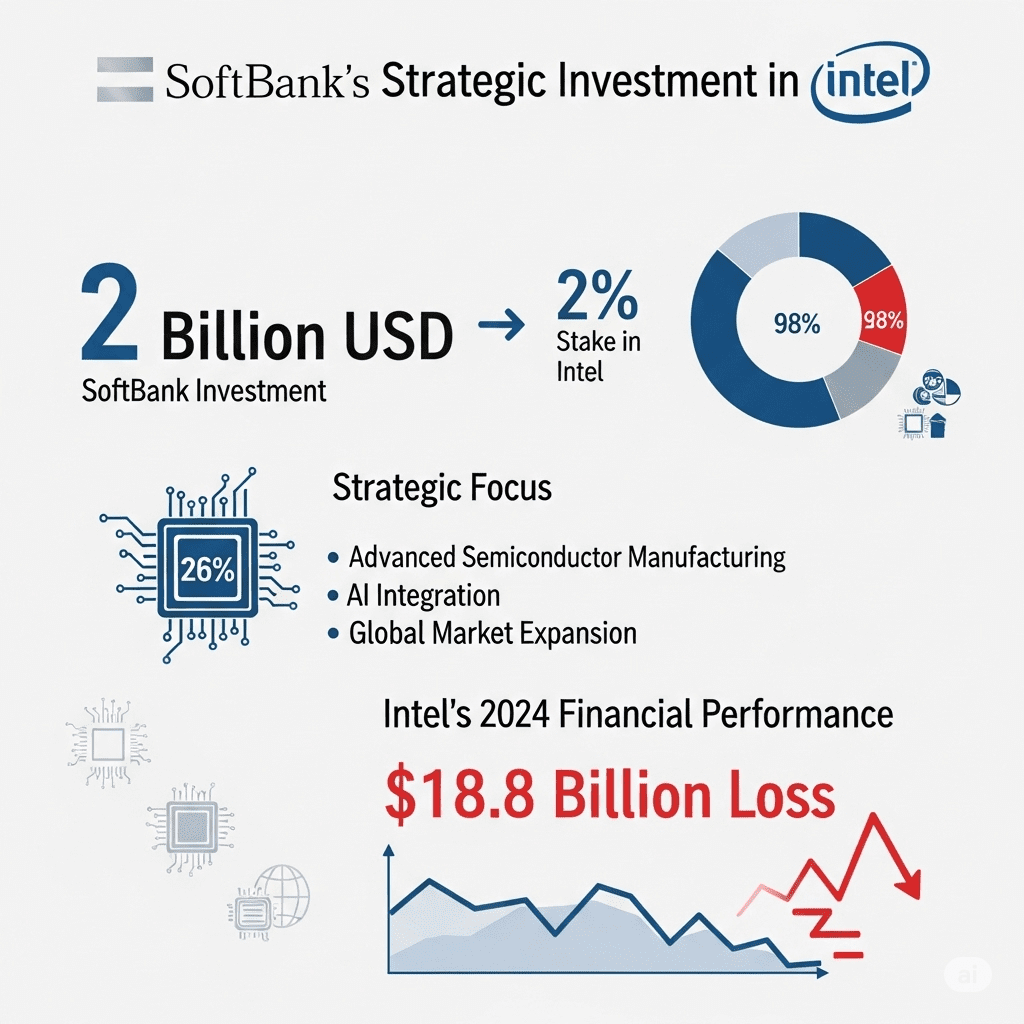

SoftBank Invests $2 Billion in Intel, purchasing common stock at $23 per share, just below the then‑market closing price of $23.66. The news sent Intel’s shares soaring by approximately 5 % in after‑hours trading, signaling renewed investor optimism amid ongoing corporate restructuring. Meanwhile, separate reports suggest the U.S. federal government may be poised to convert parts of Intel’s federal grants into a substantial 10 percent ownership stake, further underscoring the company’s strategic importance to both private and public interests

SoftBank Invests $2 Billion in Intel

SoftBank Invests $2 Billion in Intel. It will grant it roughly a 2 percent stake in Intel, making it one of the chipmaker’s largest shareholders once the transaction completes. While no board seats or purchase agreements for Intel chips were included, the move is being widely interpreted as a strong vote of confidence. SoftBank’s Chairman and CEO, Masayoshi Son, framed the deal as part of his firm’s ongoing push to back advanced semiconductor manufacturing and supply in the U.S., with Intel positioned as a key player.

Intel CEO Lip‑Bu Tan echoed the sentiment, noting that he and Masayoshi Son have “worked closely together for decades” and expressing appreciation for the vote of confidence at a critical time. SoftBank Invests $2 Billion in Intel as its broader tech-forward strategy, including a recently announced $500 billion Stargate AI initiative with OpenAI and Oracle .

Financially, the injection of capital comes at a much-needed moment for Intel, which reported a staggering $18.8 billion loss in 2024, as it grapples with fading competitiveness in AI chips and a foundry business struggling to gain traction.

A Government Lobbying for Ownership?

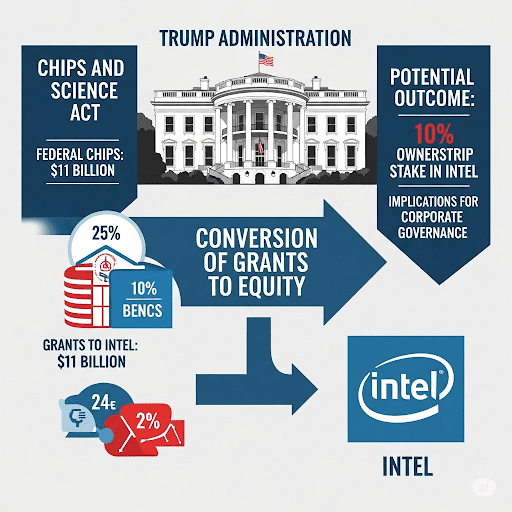

Simultaneously, reports emerged indicating that the Trump administration is exploring the possibility of transforming portions of Intel’s nearly $11 billion in federal CHIPS and Science Act grants into equity, potentially amounting to a 10 percent ownership stake.

Under the CHIPS Act, Intel had secured $7.86 billion for U.S. manufacturing expansion and up to $3 billion as a Defense‑linked “Secure Enclave” build-out for military supply chains. Already, Intel has received $2.2 billion of that award, though about $850 million remains unreimbursed, and uncertainty persists about whether future funding will be delivered.

If enacted, such an ownership conversion would make the U.S. government Intel’s largest single shareholder, reshaping the ownership landscape and raising questions about the intersection of policy and corporate governance.

Intel’s Restructuring Journey

Since March 2025, under new CEO Lip‑Bu Tan, Intel has been undergoing sweeping restructuring: plans include workforce cuts (25,000+ jobs), exit from automotive chip business, spin-offs like RealSense, and the cancellation of mega-fab expansions in Europe. Intel also continues to face fierce competition from NVIDIA and AMD in the AI specialty chip arena.

Why Does It Matters?

SoftBank Invests $2 Billion in Intel but why does it matter. Let’s find out.

- Private and public sectors converge: SoftBank Invests $2 Billion in Intel as U.S. Government Eyes 10 % Stake in Chipmaker highlight the strategic importance of Intel in national supply chains and industrial policies.

- Signal of confidence and risk: SoftBank’s move acts as a stabilizing force, while the possibility of government ownership introduces new complexities.

- Intel at a crossroads: Recently battered by losses and competitive setbacks, the chipmaker now faces a pivotal moment—potentially boosted by fresh capital, yet navigating evolving governance and national interests.

As of August 19, 2025, Intel finds itself under a dual spotlight: buoyed by a bold private-sector rescue and watched closely by a government eager to anchor its stake in America’s semiconductor future.

Featured Post

Microsoft Acquires Osmos to Supercharge AI-Driven Data Engineering in Fabric

Microsoft acquires Osmos to supercharge AI-driven data engineering in Fabric. This makes it a strategic move to accelerate and simplify data workflows within its Microsoft Fabric […]

Google Cloud and Palo Alto Networks Ink Landmark $10 B Strategic AI and Security Deal

Google Cloud and Palo Alto Networks has entered a major multi-year partnership that is set to reshape how enterprises secure cloud and artificial intelligence workloads. According […]

ServiceNow To Acquire Armis for $7.75 Billion

ServiceNow to acquire Armis for $7.75 billion. The acquisition would position ServiceNow as a stronger player in the enterprise security space, adding to its already robust […]