Blogs

How to Use SCP Command to Securely Transfer Files?

August 25, 2025

6 Cloud Hosting Advantages You Wished You Knew Earlier ( Infographics)

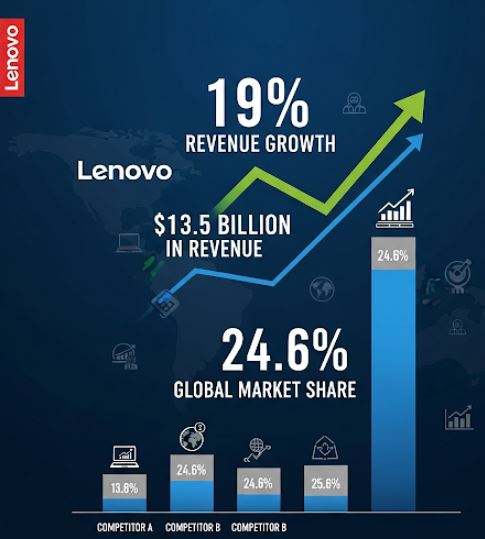

August 27, 2025Lenovo leads PC market, delivering impressive growth and gaining significant market share. The Beijing-based company has posted a remarkable 19% revenue growth in its PC division for the most recent quarter, reaching a record $13.5 billion in revenue for the period ending June 30. This marks Lenovo’s largest jump in PC sales in 15 quarters and extends its leadership in global PC shipments, capturing 24.6% of the worldwide market share—an all-time high.

Lenovo Leads PC Market thanks to surge in sales as it capitalizes on the wave of device upgrades driven by the end of support for Windows 10. Many customers are transitioning to Windows 11-compatible machines ahead of the looming October deadline, spurring demand for new devices. Industry partners have praised Lenovo’s competitive pricing, deal registration system, and support for managed service providers (MSPs), adding to the company’s reputation for solid customer relationships.

Lenovo leads PC market but its success does not end there. Overall, the company’s total sales for the quarter amounted to $18.8 billion, a 22% year-over-year increase, marking the highest revenue for any first quarter in its history. This growth was driven not only by PCs but also by gains in smartphones, infrastructure, and services. CEO Yuanqing Yang emphasized that the company has had a strong start to its fiscal year despite external challenges, including tariff volatility and geopolitical tensions.

Infrastructure Boom and AI Focus

One of the standout growth areas for Lenovo has been its infrastructure business, where server sales surged 36% year-over-year to reach $4.3 billion. The company’s success has been particularly evident in cloud service providers, AI-focused data centers, and enterprise sectors, including advertising, retail, and finance. In addition to its traditional server offerings, Lenovo’s Neptune liquid-cooled servers—which integrate Nvidia’s Blackwell GPU chips—have also seen significant growth, with a 30% revenue increase. These servers are designed to improve power efficiency by eliminating the need for fans, offering a 30% boost in power savings.

Lenovo’s ongoing shift toward AI-driven solutions is reflected in its strategy to deliver smarter AI products for both consumers and enterprises. Yang has stressed that the company is committed to advancing innovation in personal and enterprise AI, positioning itself as a key player in the rapidly expanding field. With a clear focus on driving sustainable growth, Lenovo aims to continue building operational strength and securing long-term profitability through its hybrid AI strategy.

Lenovo Leads PC Market: Dell and HP’s Response

As Lenovo leads PC market, attention turns to its two major competitors HP and Dell—as they prepare to report their earnings in the coming week. According to market research firm IDC, Lenovo currently holds a commanding lead in global PC shipments, with HP in second place at 20.8% and Dell in third at 14.2%.

HP has performed well in its own right, shipping 14.2 million units in the second quarter and gaining a 4.5% share of the market. The company has been particularly focused on overcoming supply chain challenges and reducing its dependency on Chinese manufacturing, with 90% of its North American PC production now moved outside of China, some of it landing in the U.S.

Despite HP’s strong performance, Dell has faced a more challenging period. Dell’s consumer PC sales fell by 19% year-over-year, contributing to its decline in overall market share, now at 14.2%. However, the company has found success in its commercial PC business, where it continues to hold the number one spot in North America. In an effort to regain lost ground in the consumer PC market, Dell has recently made a significant leadership change, appointing COO Jeff Clarke to head its Client Solutions Group. This move signals a more aggressive, hands-on approach to reclaiming share in the highly competitive PC space.

Industry insiders are watching closely as Dell’s management reshuffle may indicate a “bare knuckles” approach, with Clarke’s leadership expected to steer the company back into growth mode. Bob Venero, CEO of Dell Global Titanium partner Future Tech, noted that Clarke’s experience and leadership style could prove crucial in repositioning Dell’s PC business.

Conclusion

The 2025 PC refresh cycle remains a critical period for major players like Lenovo, HP, and Dell. As customers rush to upgrade their devices to meet Windows 11 compatibility, Lenovo’s strong financial results highlight its ability to capture the lion’s share of demand. HP is showing resilience with its focus on supply chain improvements, while Dell’s strategic shift under Jeff Clarke could help the company recover some of its lost ground.

Lenovo’s continued success across multiple business segments—particularly in infrastructure and AI—is positioning it well for future growth. As the company drives innovation and strengthens its presence in both personal and enterprise markets, it is likely to maintain its leadership position and continue challenging competitors as the global PC market evolves.

Featured Post

AWS re:Invent 2025: 10 Biggest Announcements

The AWS re:Invent 2025 conference was held on December 1–5, 2025 in Las Vegas, delivered a flurry of high-profile announcements, highlighting a major push toward “agentic […]

Supercomputing 2025 Elevates the AI-HPC Convergence with Performance-Driven Infrastructure

Supercomputing 2025, held in St. Louis, underscored how the high-performance computing (HPC) market is increasingly being shaped by artificial intelligence (AI) demands. From ultra-dense GPU servers […]

Microsoft Ignite 2025: Major Breakthroughs in AI, Agents and Data

At Microsoft Ignite 2025, the company made a bold push into “agentic AI” — unveiling a series of updates across Copilot, Windows, Azure and data platforms […]